Market Commentary - 2.18.14 Remember that Key Market Fundamental:

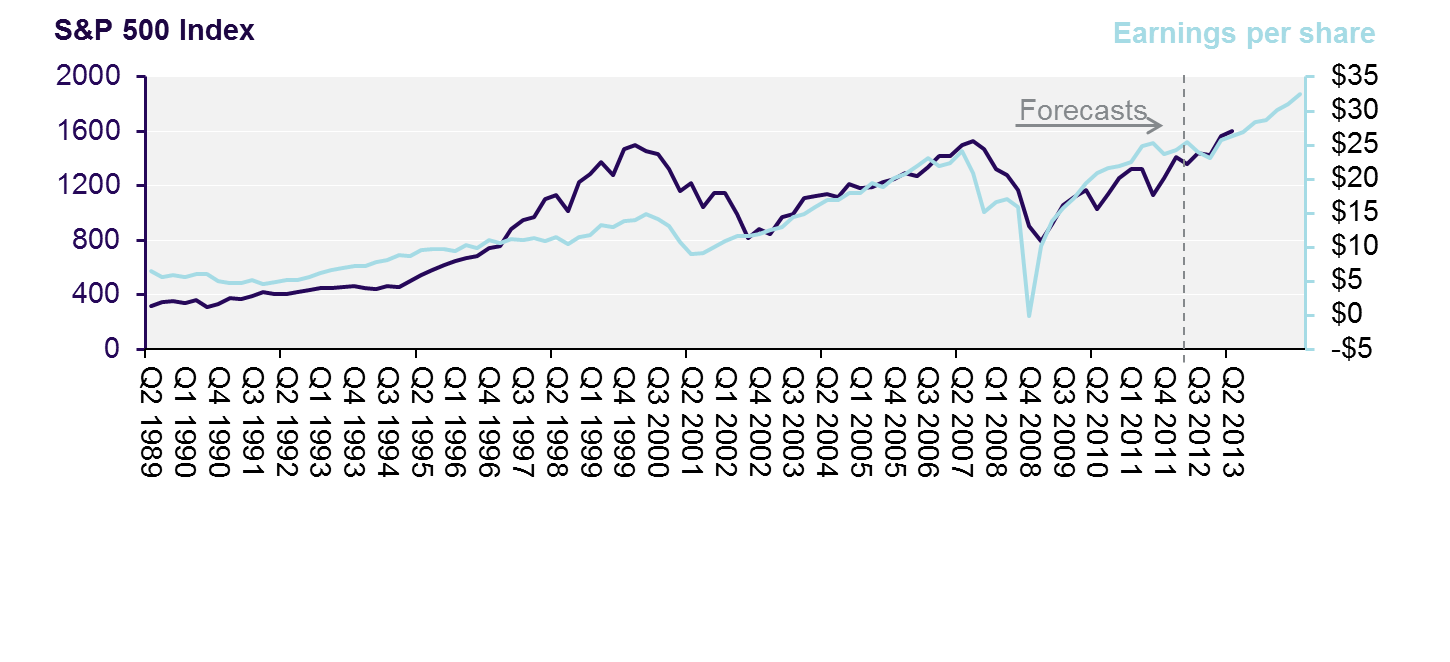

Stock Prices Follow Earnings The stock market has enjoyed a very solid run over the past five years. Unfortunately, over the last few weeks, potential market headwinds have made their appearance, shaking investor confidence. These headwinds include lingering uncertainty in emerging markets, weather causing havoc on economic data, and the Fed's tapering plans. While we believe these concerns will likely cause elevated levels of volatility and a potential market pullback, investors have to remember the key fundamental to equity investing: stock prices usually follow earnings. As seen in the chart from the Cetera 2014 Market Outlook below, performance of the S&P 500 has almost perfectly matched its growth in earnings.

Source: S&P, Cetera Research, Cetera 2014 Market Outlook

With fourth quarter earnings season nearly complete (398 companies in the S&P 500 have reported earnings so far), the results have been solid. According to Thomson Reuters:

- Fourth quarter corporate earnings for the S&P 500 are expected to grow 9.6% relative to the year ago period.

- 66% of the companies that have reported earnings have exceeded analyst expectations. The long-term average since 1994 is 63%. The Financials (74%), Technology (73%) and Materials (70%) sectors have generated the largest percentage of companies beating their estimates. The weakest sectors have been Telecom (50%), Consumer Staples (55%), and Energy (59%). In aggregate, companies are reporting earnings that are 3% above estimates, matching the 3% long-term average.

- 64% of companies have reported revenues above expectations. This figure is higher than the long-term average of 61% and higher than the average of 55% over the past four quarters.

While potential market headwinds have taken center stage this year (the S&P 500 fell 3.6% in January), we advise that investors remain focused on fundamentals. Yes, the stock market is due for a pause or even pullback, however, offering support is another quarter of solid corporate earnings. When headwind noise becomes especially loud, as it has this year, focusing on stock market fundamentals, especially the size and direction of earnings growth, is prudent. With all of this information, we remain committed to 2014 market prognosis of mid- to upper-single digit returns and increased volatility. From a portfolio standpoint, we continue to target increased diversification, less interest rate sensitivity and equity exposure in line with stated investment objectives. This information compiled by Cetera Financial Group is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The information has been selected to objectively convey the key drivers and catalysts standing behind current market direction and sentiment.

No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular news update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in indices. This is not an offer, recommendation or solicitation of an offer to buy or sell any security and investment in any security covered in this material may not be advisable or suitable. Please consult your financial professional for more information.

While diversification may help reduce volatility and risk, it does not guarantee future performance. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Affiliates and subsidiaries and/or officers and employees of Cetera Financial Group or Cetera Financial Specialists LLC may from time to time acquire, hold or sell a position in the securities mentioned herein. |